Earnout payments have been nearly ubiquitous in biotech M&A transactions for the past decade. Given the risks, costs, and timelines in drug R&D, these contingent value rights, or “biobucks”, play an important role in bridging the gap in valuation expectations between seller and buyer.

Their importance, and data around their likelihood of being paid out, has been the subject of at least three past blogs (in 2012 here, here; and in 2015 here). It’s fair to say that the earlier 2012 datasets were very scant – but thanks to Shareholder Representative Services (SRS Acquiom), we’ve gotten a few updates since then.

Don Morrissey and his colleagues at SRS Acquiom have just released their latest report: the 2016 SRS Acquiom Life Sciences M&A Earnout Achievement Update.

This update includes 104 life science deals representing over $62.5B in total value. This includes $27.5B in earnouts across 700 milestone payments in the life sciences – just about evenly split between biopharma and medtech.

For those new to these data, SRS Acquiom is hired by sellers to keep tabs on the buyers’ progress, including things like escrows and milestones. Because of this, they have insight into which milestones are “supposed to have been met” over time and can classify them as hit, missed, delayed but likely, or delayed but unlikely.

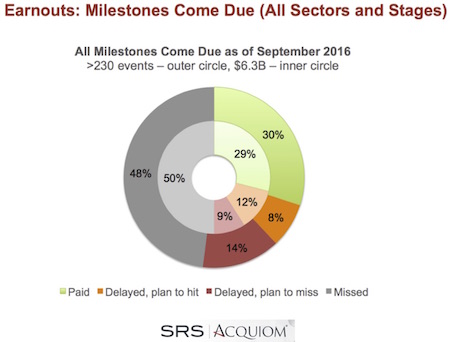

This September 2016 update includes over 230 individual milestone events and $6.3B in earnout consideration from deals that have closed since 2008. This represents nearly a 2x increase in the number of milestone events in the dataset than the spring 2015 report, and 10x more than in the 2012 report. So its starting to feel like a robust dataset.

In line with the general conclusion from prior blogs, “roughly a third” of all M&A milestones that were expected to be met by now have been paid out. Here’s the graph for all sectors:

Here are a few specific take-aways:

- Over time, we’ve seen some downward pressure on rate of milestone achievement. Numerically, SRS Acquiom has seen a downtick versus the 2015 dataset (38% vs 30% overall have been paid to date, in the 2015 and 2016 datasets respectively). As time progresses this should be expected, given the dependency of future milestones on the success of past ones.

- BioPharma earnouts continue to deliver: these deals have hit or plan to hit a delayed event in 40% of the milestones that have come due in the current 2016 dataset, representing 43% of the value of the earnouts payments. Slight differences from MedTech exist in the dataset, but hard to know their significance.

- Bigger deals are more likely to meet their milestones. Analyzing only the 58 milestones associated with BioPharma deals with greater than $50M in upfront payments, 54% of them have been paid or are likely but delayed. This reinforces the intuitive expectation: when Pharma is more serious about its conviction on deal (i.e., willing to pay more), it’s more likely to actively pursue it through development – triggering more milestones. For deals where the upfront is tiny, these milestones can just be “fliers” that Pharma gives away to get the deal done but gives up on progress quickly.

- Early stage deals have seen high rates of milestone delivery. Nearly 60% of the IND and Phase 1 stage milestones that have come due have been paid or are delayed but still likely to be met. This bodes well for early stage deal-making. And is also intuitive: if Pharma is willing to buy a preclinical program rather than wait for data, it must be excited about progressing it into early development. With preclinical rates of success in drug R&D in the 60-80% range (depending on data source), one would expect these milestones to reflect underlying attrition rates – this appears to be trending toward the case (with relative few milestone events).

As in the past, the report covers various deal terms and contract issues as well. One that leaped out at me: serious disputes about milestones have occurred in 36% of deals that have already met at least one milestone, and these disputes typically involve disagreements over progress and changing plans. This is up from 30% in the 2015 report – hard to know whether that’s noise or if more disputes are indeed on the rise.

For further discussion about life science earnouts and this latest update, I encourage you to attend a live presentation of the study’s findings on December 14th at Goodwin’s Boston office. Michael Gilman, Atlas EIR and founder/CEO of both Padlock Therapeutics and Stromedix, Don Morrissey of SRS Acquiom, and Kingsley Taft of Goodwin will lead the discussion. For more information and to RSVP click here.